Today's Top Stories in Less Than 2 Minutes

Fed Officials and Treasury Secretary Weigh In on Rate Cuts, Inflation, and Economic Outlook

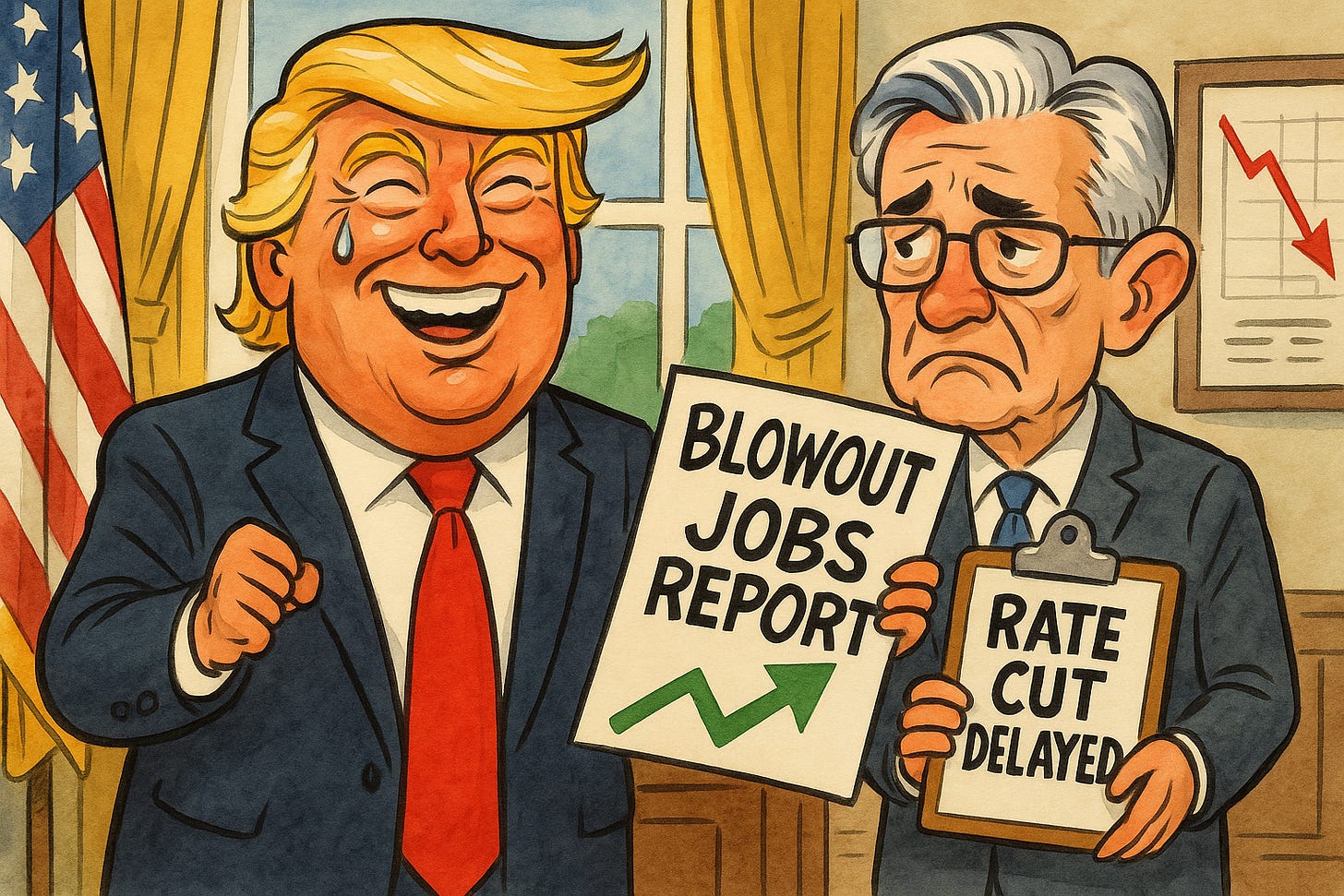

In a series of statements and Q&A sessions, key financial figures shared insights on the current economic landscape. US Treasury Secretary Bessent commented on Federal Reserve policy, suggesting that if the Fed doesn't cut rates now, a larger cut might occur in September. He emphasized that while it's the Fed's decision, real interest rates are currently very high.

U.S. Jobless Claims Hit 6-Week Low, Signaling Strong Labor Market

U.S. jobless claims dropped to 233,000 last week, reaching a 6-week low. This decline indicates a continued trend of low layoffs in the country.

🎯Other Most Surfaced Stories on Market Flux

U.S. Job Growth Beats Expectations, Unemployment Falls to 4.1%

U.S. job growth exceeded expectations in June, with 147,000 jobs added versus the forecast of 110,000. The unemployment rate fell to 4.1%, lower than the expected 4.3%.

Wall Street Rallies to Record Highs on Surprising Jobs Data

Wall Street is set to open higher as stocks hit fresh record highs following a stronger-than-expected June jobs report. The surprise data boosted investor confidence in the economy's health.

Trump's Vietnam Trade Deal Boosts Markets, Tax Bill Faces House Hurdles

President Trump announced a new trade deal with Vietnam, imposing tariffs on Vietnamese exports while allowing US exports at 0%. The deal boosted US markets, with the S&P 500 and Nasdaq closing at record highs.

House Poised for Crucial Vote on Trump's Controversial Tax and Spending Bill

President Trump announces the House is ready to vote on a "big beautiful bill" tonight. The Republican House majority appears united after extensive discussions.

🎯Company Highlights

Nvidia Corporation (NVDA)

Performance Overview

1D Change: 1.25%

5D Change: 2.66%

News Volume: 119

Unusual Volume Factor: 1x

Nvidia Nears Historic $4 Trillion Valuation as AI Boom Propels Tech Sector to New Heights

In a historic moment for the tech industry, Nvidia is on the verge of becoming the world's most valuable company. The chipmaker's market capitalization has soared to an unprecedented $3.92 trillion, driven by Wall Street's unwavering optimism about artificial intelligence (AI). Nvidia's stock reached an all-time high of $158.72, putting it within striking distance of the $4 trillion market cap milestone – a feat no company has ever achieved.

Full coverage of $NVDA on MarketFlux.io

Blackrock, Inc. (BLK)

Performance Overview

1D Change: 1.12%

5D Change: 4.98%

News Volume: 52

Unusual Volume Factor: 1x

BlackRock's Bitcoin ETF Outshines S&P 500 Fund as Company Mulls Saudi Pipeline Stake Sale

BlackRock, the world's largest asset manager, is making headlines with several significant developments. The company's Bitcoin ETF has shown remarkable performance, overtaking its flagship S&P 500 fund in revenue. This success comes as Bitcoin ETFs experienced a substantial inflow of $408 million, highlighting the growing interest in cryptocurrency investments.

Full coverage of $BLK on MarketFlux.io

Synopsys, Inc. (SNPS)

Performance Overview

1D Change: 4.43%

5D Change: 10.23%

US Lifts China Chip Software Export Ban, Synopsys and Cadence Stocks Surge

In a significant policy shift, the US has lifted export restrictions on chip design software to China, marking a trade truce move. This decision, announced by the Commerce Department, reverses the May restrictions and has sent ripples through the tech industry.

Full coverage of $SNPS on MarketFlux.io

S&P 500 SPOTLIGHT

S&P 500: 6,279.35 | +51.93 | +0.83%

1-Week Performance S&P 500 Members:

MarketFlux.io is a real-time financial news and analytics aggregator that gathers textual news from over 350 sources, providing instant insights and advanced filtering capabilities. With AI-powered sentiment analysis, historical search, and customizable filters, MarketFlux.io enables traders and investors to efficiently track market-moving events as they unfold. Visit Marketflux.io

© 2025 MarketFlux. All rights reserved.